Overview

Since its independence in 1991, Moldova has suffered from endemic corruption and is usually referred to as the poorest country in Europe. Reports indicate that corruption in Moldova is rampant in the judiciary, executive, legislative and generally in the public sector.1 Indicators also show a substantial lack of transparency in the private sector, especially the banking system.

Moldova’s corruption problems have worsened significantly in the past ten years, with experts referring to the country as a case of state capture.2 Particularly, throughout the past decade, oligarch Vladimir Plahotniuc and other interest groups managed to build substantial influence over the parliament, the executive as well as anti-corruption bodies and the judiciary.3 Lip service towards anti-corruption reform and politically targeted corruption prosecutions have been carried out, especially in the past four years, in an attempt to convince Moldovans and international stakeholders that the country is advancing towards transparency and accountability.

In reality, Moldova has managed to become in a few years a regional center to launder billions from Eastern Europe to the EU and a place for corrupt officials and criminals to steal billions of dollars and to protect themselves from prosecution.4 Among other worrying measures, interest groups have recently (summer 2018) tried to secure a law about capital amnesty and decriminalisation of economic and financial crimes. This new draft law, which came after several attempts that failed due to civil society and international pressure, would allow the legalisation of impunity and would seriously undermine any effort to conduct investigations and prosecutions over major corruption and fraud cases and therefore to recover millions in assets from these cases.5 These developments, along with anti-liberal measures, including a controversial electoral law6 and repeated attacks against civil society and investigative journalists,7 significantly deteriorated Moldovan relations to the EU and other partners, putting a halt to the EU accession process.

Two major cases exemplify – and have shaped the political discourse around – Moldova’s huge problems of money laundering, asset theft and state capture in the past decade: the role of the country in the so-called Russian Laundromat and the USD 1-billion bank fraud in 2014.

Moldova and the "Russian Laundromat"

Moldova played a key role in a large cross-national money laundering scheme which moved billions of dollars from Russia to the EU between 2010 and 2014, according to a 2014 investigation by OCCRP.8 The scheme is alleged to have involved the use of offshore companies in the UK and tax havens, banks in Latvia and corrupt judges in Moldova. Typically, it entailed that two offshore companies based in the UK and whose real ownership was hidden through tax havens agreed to fictitiously lend each other large sums of money. The debt was to be guaranteed by a company in Russia owned by a Moldovan citizen. This element was key, since it allowed the unpaid loan to be settled in a Moldovan court, where a judge would certify the debt, “obliging” the Russian guarantee company to pay for it. Subsequently, the legalised debt would be transferred with the intermediation of a Latvian bank and the Moldovan bank Moldinconbank, opening its way into the EU.

According to the OCCRP, over 20 judges in Moldova helped launder over USD 20 billion from Russia to Europe, a staggering figure for a tiny and poor country such as Moldova. The Superior Council of Magistracy allegedly did not follow up on these cases, despite being aware of them, until late 2016, when 15 judges were arrested – and, one year later, freed.9 These measures, along with amendments in tax and banking regulations, attempts to decriminalise financial crimes and changes in the institutional financial setup, were arguably part of a project to transform Moldova in Eastern Europe’s largest money laundering centre, taking the place of Latvia, after the latter started to comply with EU requirements on transparency and anti-money laundering in order to become an EU member.

The one billion bank fraud

In late 2014 a huge corruption case hit Moldova – the infamous “1 billion bank fraud”. The scandal, involving three of the largest banks of the country – Banca de Economii, Banca Sociala and Unibank, holding at the time around one third of the country’s assets – put the fragile economic and banking system in Moldova severely at risk, robbing the country at least 1 billion dollars, around 15% of its annual GDP. At the end of November 2014, days before national elections, the three Moldovan banks transferred in just two days up to USD 1 billion in loans to companies owned by anonymous individuals. The assets, which the banks paid out with reserves of the National Bank of Moldova, were transferred to bank accounts in Latvia or in offshore companies in Hong Kong and the UK, according to investigations.10

Expert analysis and investigations showed that this operation was conducted in a highly coordinated, structured way and was made possible thanks to the support of key financial and political institutions.11 According to the main investigation that followed the fraud, commissioned by the Moldova National Bank to the US investigation company Kroll in 2015, the mastermind of this plan was the political figure and entrepreneur llan Shor.12 Plans to conduct this sophisticated theft started as early as 2012, when interest groups started aggressively buying shares of the involved banks, the banks were then decapitalised by lending assets in a much higher amount than they were able to give out, with the purpose to involve the National Bank in lending them liquidity through its reserves. A key step to facilitate this process was when, in 2014, the government changed the legislation governing the bank system, creating the legal grounds for emergency loans the National Bank could give to commercial banks under government guarantee.

After November 2014, the National Bank of Moldova put the banks in special administration, after which they went bankrupt and were liquidated. In September 2016, as it was clear that the banks would have never been able to repay their loans, the government decided to put the burden of the accumulated debt on the taxpayers: as such, the Moldovan domestic debt was to be more than tripled in just a year and the fraud debt to be repaid in the next 25 years.13

Recovering the stolen billion

Government efforts to trace and recover the billion stolen with the 2014 bank fraud case have generally been assessed as poor. The political will of the government and of the other institutions involved, given their alleged involvement in the case, is predictably very weak.

Investigations

Shortly after the theft, the government decided to hire Kroll, a due diligence company from the US to investigate the case, showing to some extent willingness to clarify what led to the fraud case and what happened to the stolen debt. The final report was not made public until a Moldovan MP decided to leak it in 2015. Its findings shed light on the massive theft, especially about the involvement of banks and of key PEPs such as Ilan Shor. It also gave some indications about the alleged location of the assets abroad. A second report prepared by Kroll in late 2017, the main findings of which were made publicly available by the National Bank of Moldova, further detailed the fraud scheme, explaining that most of the stolen assets were channelled through Latvian banks towards British offshore companies, also listing a number of countries of final destination of the laundered assets, including Cyprus, China, Russia, Switzerland, USA and Hong Kong.14 Names of individuals involved, however, were not released.

Since the first report was prepared and up to this day, little has been done to follow up on its findings. Notwithstanding declarations of commitments, there has been a substantial lack of transparency in investigations, with experts saying that zero to little progress has been made to trace the assets and link them to the responsible individuals since the fraud took place in 2014.15 On the contrary, according to research, the Moldovan government has actively tried to create a certain perception around how the two cases took place and to ensure Moldovans and international partners that investigations are ongoing.16 A major obstacle to the investigations has also been that shortly after the theft, in November 2014, a vehicle transporting large amounts of bank documents related to the case was stolen and burned.17

As for prosecution, Ilan Shor, the alleged mind behind the fraud, was brought to court and put under house arrest, although he managed at the same time to become mayor of a small Moldovan town. Other high-level arrests and prosecutions included former prime minister Vlad Filat and Veaceslav Platon, a powerful and well-known corporate raider. These prosecutions have been criticised for having been carried out in breach of procedures, behind closed doors and of being politically motivated.18

There is also no publicly available information about requests of mutual legal assistance from Moldovan authorities to foreign jurisdictions on help in investigations, nor did the experts CiFAR met in Chisinau mention that such requests took place.

Asset recovery

Similarly, experts argue that little or zero progress has been made to recover the assets from the bank fraud.19 Interestingly, the Ministry of Finance referred in 2017 to the assets obtained from the liquidation process of the three involved banks as “asset recovery”, while in reality the proceeds of the liquidation had nothing to do with the assets stolen in 2014.20 There is no indication that Moldova has requested mutual legal assistance from foreign jurisdictions on starting the recovery processes of the assets from the 1 billion case.

International Institutional Engagement

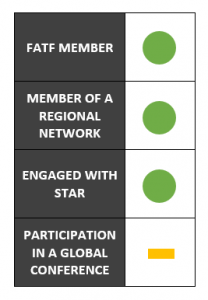

Moldova is not a member of FATF, nor has it participated in global conferences and initiatives around asset recovery. It is however a member of the FATF associated anti-money laundering committee “Moneyval” in the framework of the Council of Europe.21 Commitments on anti-money laundering, anti-corruption and asset recovery are also included in the framework of the EU Association Agreement and negotiations for EU membership.22

Moldova is an observer State to the Camden Asset Recovery Inter-Agency Network (CARIN). No international forums have included Moldova as a focus country.

Our reports on Moldova

Sources

[1] https://www.business-anti-corruption.com/country-profiles/moldova/ . See also: http://www.transparency.md/wp-content/uploads/2017/02/TI_Moldova_Corruption_And_Quality_of_Governance_The_Case_Of_Moldova.pdf

[2] http://www.transparency.md/2017/06/16/state-capture-the-case-of-the-republic-of-moldova/

[3] http://www.transparency.md/2017/06/16/state-capture-the-case-of-the-republic-of-moldova/

[4] https://www.riseproject.ro/investigation/grand-theft-moldova/

[5] http://www.transparency.md/wp-content/uploads/2018/09/Observator-Nr.12-ENG.pdf

[6] https://www.rferl.org/a/moldova-electoral-law-european-commission-closely-monitoring/28771778.html

[7] https://crjm.org/wp-content/uploads/2018/03/2016-2017-radiography-NGO-attacks-EN.pdf

[8] https://www.reportingproject.net/therussianlaundromat/russian-laundromat.php

[9] https://alaiba.files.wordpress.com/2018/05/too-big-to-jail_policy-brief-alaiba.pdf

[10] https://www.bbc.com/news/magazine-33166383

[12] https://www.bbc.com/news/magazine-33166383

[14] https://bnm.md/files/Kroll_%20Summary%20Report.pdf

[15] https://alaiba.files.wordpress.com/2018/05/too-big-to-jail_policy-brief-alaiba.pdf

[16] http://www.transparency.md/wp-content/uploads/2018/06/Observator-Nr.10-ENG.pdf

[17] https://www.riseproject.ro/investigation/grand-theft-moldova/

[18] https://alaiba.files.wordpress.com/2018/05/too-big-to-jail_policy-brief-alaiba.pdf

[19] http://www.transparency.md/wp-content/uploads/2018/06/Observator-Nr.10-ENG.pdf

[20] https://alaiba.files.wordpress.com/2018/05/too-big-to-jail_policy-brief-alaiba.pdf

[21] http://www.fatf-gafi.org/countries/#Moldova

[22] See in particular Article 18 of the 2013 EU Association Agreement: “The Parties shall cooperate in order to event the use of their financial and relevant non-financial systems to launder the proceeds of criminal activities, as well as for the purpose of terrorism financing. This cooperation extends to the recovery of assets or funds derived from the proceeds of crime.” https://eur-lex.europa.eu/legal-content/ro/TXT/?uri=uriserv:OJ.L_.2014.260.01.0004.01.ENG