Overview

Several anti-corruption and asset recovery related laws exist in Mozambique, however these laws are not implemented effectively and do not cover all areas needed to reduce corruption risks and provide checks and balances over institutions of government, making high-level corruption a particular concern.1 This is reflected in the poor ranking in Transparency International’s Corruption Perception Index 2018 and in the International Centre for Asset Recovery’s Anti-Money Laundering Index 2018.

Mozambique is neither a frequent a country of origin nor of destination for international asset recovery cases, meaning that government officials and civil society cannot draw on experience to navigate the complexities of the process. Consequently, the 2016 Hidden Debts case represents a challenge to all societal actors.

Hidden Debts Case

The Hidden Debts case involves a concealed US$2 billion loan from the UK branches of the Swiss Bank Credit Suisse and the Russian Bank VTB Capital to partially state-owned companies in Mozambique, which received a state guarantee on the loan. Of this loan, US$850 million was provided to Empressa Moçambica de Atum, US$622 million to ProIndicus and €535 million to Mozambique Asset Management. Confusion and dispute exists regarding the original purpose of the loans, but what later became clear was that the larger part of it was earmarked for maritime security. However and despite legislative requirements, Parliament was not informed of these loans, with details only becoming public following a statement from Mozambique authorities that they were unable to service their debts.2 Further, it appears that the three companies were only established shortly before the banks provided the loans and that they all had the same CEO, at the time a senior officer in the security services.3 The GDP of Mozambique was US$11 billion in 2016, meaning that the loan represented a substantial amount of money for the country.4

Failures that have been identified with the loan process include the lack of parliamentary oversights that should have prevented the government from guaranteeing the loan unilaterally and in secret and the role of the banks with respect to their due diligence checks.5

In November 2016, an audit of the loans was undertaken by the risk assessment firm Kroll, which also sought to make sense of what had taken place. According to their report:

- Approximately US$500 million remained unaccounted for by their auditors. This amount was alleged to have been included in the State budget and/or used to buy military equipment, but Kroll was unable to corroborate this.

- There is a suspected inconsistency of approximately US$713 million between the cost of equipment purchased for maritime security and the costs that should be incurred according to an independent expert.

- An undisclosed bank account held by the firm Empressa Moçambica de Atum and a payment to Credit Suisse of US$51 million needed more explanation 6

These findings were challenged by the companies involved in the Hidden Debt case,7 however in January 2018 the Public Prosecutor launched proceedings at the Administrative Tribunal against the managers of the public companies. This Tribunal can issue financial penalties but means that criminal charges are unlikely.8

Processes in Mozambique are at an early stage regarding this case and it is unclear where, when and whether a case will begin that will involve an international asset recovery component. Limited capacity and resources of the government to investigate and prosecute international asset recovery cases is one factor in this, but there are also questions over the ownership of the US$2 billion that will need to be resolved if asset recovery is to take place.

International Institutional Engagement

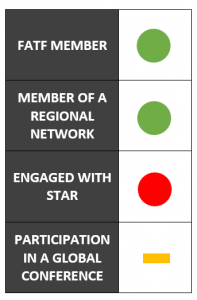

Mozambique has been a member of the Asset Recovery Inter-Agency Network of Southern Africa (ARINSA) since 2017. This network is a regional informal network that seeks to exchange information, as well as best practice, on asset forfeiture, confiscation and money laundering in Southern Africa.9 ARINSA’s 2017 report, on the joining of Mozambique, highlighted that Mozambique is currently lacking an asset management unit, an asset forfeiture unit and an asset forfeiture fund, as well as not having adequate anti-money laundering legislation in place.10

Mozambique is also a member of Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG), which is a regional body implementing the FATF Forty Recommendations.

While the latest FATF report is not publicly accessible online, other sources indicate that Mozambique faces compliance issues with the FATF recommendations11 and is taking steps to improve anti-corruption measures.12

As of the latest published information in December 2017, Mozambique had not participated in any StAR events or engagements.13 Mozambique was not a focus country at the Global Forum for Asset Recovery, nor has there been a regional equivalent.

Our reports on Mozambique

Sources

- Bertelsmann Stiftung, Transformation Index 2018: Mozambique, http://www.bti-project.org/en/reports/country-reports/detail/itc/moz/ [accessed 26 May 2018]; Global Business Anti-Corruption Portal: Mozambique, https://www.business-anti-corruption.com/country-profiles/mozambique/ [accessed 26 May 2018].

- Constanze Blum, Transnational Organized Crime in Southern Africa and Mozambique, FES Peace and Security Series, Friedrich Ebert Stiftung, 2016, p- 18-20.

- International Monetary Fund, Republic of Mozambique: Selected Issues, March 2018, pp.20-21.

- World Bank Data: Mozambique, https://data.worldbank.org/country/mozambique [accessed 10 April 2018].

- Blum, no.1, p. 19-20.

- Kroll, Independent audit related to loans contracted by ProIndicus S.A., EMATUM S.A. and Mozambique Asset Management S.A., 23 June 2017, https://www.open.ac.uk/technology/mozambique/sites/www.open.ac.uk.technology.mozambique/files/files/2017-06-23_Project%20Montague%20-%20Independent%20Audit%20Executive%20Summary%20English%20(REDACTED%20FOR%20PUBLISHING).pdf, Joseph Hanlon, Kroll full report 3: Kroll points fingers at Finance Ministry, Credit Suisse & Palomar – Hanlon, Club of Mozambique 10 September 2017, http://clubofmozambique.com/news/kroll-full-report-3-kroll-points-fingers-at-finance-ministry-credit-suisse-palomar-hanlon/ [accessed 2 May 2018], Jubilee Debt Campaign, 100 UK MPs criticise Mozambique secret lenders ahead of debt talks in London, 19 March 2018, https://jubileedebt.org.uk/press-release/100-uk-mps-criticise-mozambique-secret-lenders-ahead-of-debt-talks-in-london [accessed 10 May 2018].

- Borges Nhamire and Matthew Hill, Mozambican Companies That Hid $1.4 Billion Debt Slam Kroll Audit, Bloomberg 10 October 2017, https://www.bloomberg.com/news/articles/2017-10-09/mozambican-companies-criticized-over-debts-slam-kroll-audit [accessed 11 May 2018].

- Joseph Cotterill, Mozambique’s prosecutor opens case into $2bn hidden loans scandal, Financial Times 29 January 2018, https://www.ft.com/content/c82857c8-0500-11e8-9650-9c0ad2d7c5b5 [accessed 11 May 2018].

- https://new.arinsa.org/

- ARINA, Annual Report 2017, p. 21.

- Know your country: Mozambique, https://www.knowyourcountry.com/mozambique1111 [accessed 02 May 2018].

- International Monetary Fund, Republic of Mozambique: Selected Issues, March 2018, p.20.

- https://star.worldbank.org/star/content/milestone-stolen-asset-recovery