Overview

The Eastern and Southern Africa Anti-Money Laundering Group’s 2021 mutual evaluation report identified that, while Mozambique has made progress in recent years, risks of money laundering remain high. The report highlighted notably the lack of a National Risk Assessment for money laundering and terrorism financing, a lack of investigations following risks identified by the Financial Intelligence Unit, and a failure to routinely start financial investigations to trace the proceeds of crime. Overall, the report points out a range of deficiencies, including in investigation, prosecution, conviction and, eventually, confiscation of laundered money, and in anti-terrorism financing, including low capacity and lack of operational independence of law enforcement agencies.

In the same vein, Transparency International and its Mozambican counterpart Centro de Integridade Publica (CIP) have lamented the country’s stagnation in terms of legal action taken against officials, despite the revelations that came out of the Hidden Debt scandal, and which bruised trust in public bodies and greatly destabilised the country’s economy.

Domestic CSOs working on governance issues have a relative operational freedom but face administrative obstacles, threats and, in limited incidences, violence. According to CIVICUS, journalists also face ongoing attacks. CIVICUS ranks the civil society space as ‘obstructed’, while Freedom House ranks Mozambique as partly free. Due to the conflict in the Capo Delgabo region, the presence of several armed groups, a ruling party in power for nearly 30 years and the high numbers of internally displaced persons, political tensions in the country are increasing the pressure for transparency and accountability.

In recent years, Mozambique has made some progress in developing a legal and institutional anti-corruption framework, especially regarding asset recovery. With the support of the International Center for Asset Recovery and of the Office of the Attorney General, a new law on asset recovery was passed in 2021, representing an important step toward empowering the prosecutors to understand and access data as well as enabling Mozambique to recover illicit assets. The law provides, for example, for the extended confiscation of assets of persons accused of corruption.

Various institutions tackle the topic of asset recovery, corruption and money laundering in the country. This includes the Central Office for Fighting Corruption/ Gabinete Central de Combate à Corrupção (GCCC), the Ministry of State Administration and Public Service, the Central Ethics Commission, the Financial Intelligence Unit of Mozambique (GIFiM), and the Central Bank of Mozambique. The GCCC has bilateral cooperation agreements with counterparts from the UK, several Portuguese-speaking countries, and neighbouring countries.

Asset recovery in Mozambique

The Hidden Debt case is the major asset recovery case in Mozambique. It involves a concealed USD 2 billion loan from the UK branches of the Swiss Bank Credit Suisse and the Russian Bank VTB Capital to partially state-owned companies in Mozambique, which received a state guarantee on the loan. Of this loan, USD 850 million was provided to Empressa Moçambica de Atum, USD 622 million to ProIndicus and €535 million to Mozambique Asset Management between 2013 and 2014. Confusion and dispute exist regarding the original purpose of the loans, but what later became clear was that the larger part of it was earmarked for maritime security. However and despite legislative requirements, parliament was not informed of these loans, with details only becoming public following a statement from Mozambican authorities that they were unable to service their debts. Further, it appears that the three companies were only established shortly before the banks provided the loans and that they all had the same CEO, at the time a senior officer in the security services. The GDP of Mozambique was USD 11 billion in 2016, meaning that the loan represented a substantial amount of money for the country.

An audit of the loans conducted by Kroll in 2016 assessed that:

-

- Approximately USD 500 million remained unaccounted for by their auditors.

- There is a suspected inconsistency of approximately USD 713 million between the cost of equipment purchased for maritime security and the costs that should be incurred according to an independent expert.

- An undisclosed bank account held by the firm Empressa Moçambica de Atum and a payment to Credit Suisse of USD 51 million needed more explanation.

The Hidden-Debt scandal was a defining moment for the anti-corruption effort. The government, development partners and some CSOs turned their attention to asset recovery in contrast to corruption investigations. Reforms included the passage of the 2019 Mutual Legal Assistance Law, which empowers the Minister of Justice to decide on extradition requests and coordinate asset recovery efforts through a dedicated office for asset recovery. The legislation assigns the judiciary to extradite people sought by other countries’ justice authorities for being suspected of having committed crimes.

The tracing of the stolen assets has been exceptionally difficult, due to limited cooperation amongst implicated parties and only a fraction of the assets from the hidden-debt scandal have been traced so far.

Nevertheless, 2021 saw the long-awaited trial for this case finally begin. Among eighteen others, Ndamdi Guebuza, son of the past President, Gregorio Leao, former Head of Intelligence, and Antonio do Rosario, chairperson of all three involved companies, are facing charges. In a separate, US indictment, three Credit Suisse employees in London–including the Managing Director and two other senior bank staff, the former Mozambican Finance Minister Manuel Chang, Teofilo Nhangumele from the Office of the President of Mozambique, Lebanese national Jean Boustani, and Najib Allam– were charged as lead conspirators.

In the same year, Crédit Suisse pled guilty to “conspiracy to wire fraud” and agreed to a settlement of USD 475 million in fines with the U.S. and U.K. authorities, as well as to write off USD 200 million in Mozambique’s debt.

International Institutional Engagement

Mozambique has been a member of the Asset Recovery Inter-Agency Network of Southern Africa (ARINSA) since 2017. This network is a regional informal network that seeks to exchange information, as well as best practice, on asset forfeiture, confiscation and money laundering in Southern Africa.

Mozambique is also a member of Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG), which is a regional body implementing the FATF Forty Recommendations.

Our work in Mozambique

Since 2019, CiFAR has been engaged with Mozambican CSOs in developing learning and knowledge exchange towards the advancement of asset recovery in the country, especially linked to the Hidden Debt case. This scandal galvanized CSOs in Mozambique in demanding from the government not only progress on the repatriation of assets, but also sustained efforts to stop grand corruption and increase transparency and accountability.

However, Mozambican NGOs working on asset recovery quite often face safety and security risks and have to deal with a lack of resources, both human and financial, which clearly undermines their hability to promote the necessary changes to the the national asset recovery framework.

Together with our partners in Mozambique, we identifyed the following strategic priorities, driving our work in the country:

- Supporting CSOs to promote the enforcement of domestic laws by empowering the Asset Recovery Office, advocating for the necessary financial resources, and enhancing its technical capacity through cooperation with CSOs, sharing best practices and providing technical guidance;

- Supporting CSOs to promote improving the efficiency and transparency in returned asset management, with the active involvement of civil society in decision-making processes on how the assets are to be used for social purposes, as well as in monitoring the (social) re-use of the assets;

- Contributing to tracing assets related to the Hidden Debt case and pushing authorities and law enforcement in Mozambique to progress in cases, namely through CSO led-advocacy on the importance of investigating and prosecuting at home and abroad;

- Promoting stronger involvement of CSOs in asset recovery , especially regarding the Hidden Debt case, by providing them with targeted support aimed at increased collaboration, technical capacity and knowledge on asset recovery processes, and increased networking opportunities on asset recovery, both at the national and international levels.

- Promoting knowledge and CSO strategic planning to advance international anti-corruption sanctions as a tool to advance asset recovery in Mozambique.

Current projects

Improving asset recovery frameworks in Kenya and East and Southern Africa

At the continental and regional level, many developments have been taking place in Africa around asset recovery. Not least of these is the recent development of the Common African Position on Asset Recovery. With this project, we want to build on CiFAR’s previous and current engagement in Kenya and in East and Southern Africa, aiming to increase the efficiency, transparency and accountability of asset recovery in the region.

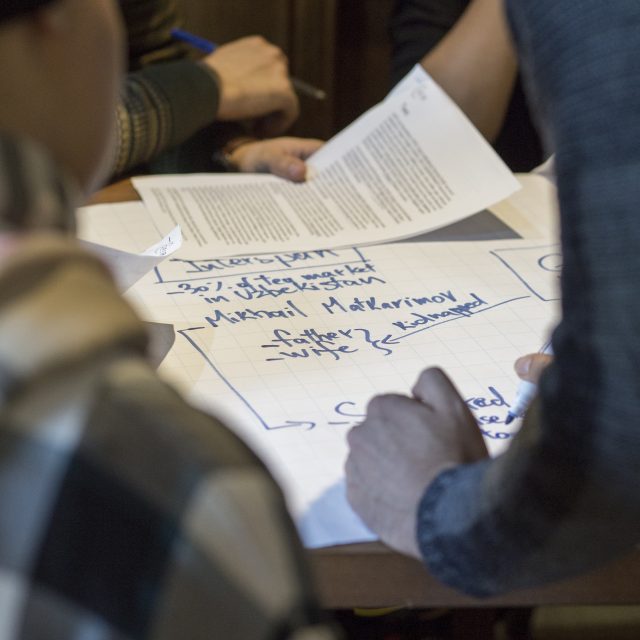

Investigate East and Southern Africa

Starting in March 2023, we held the fifth instalment of our Investigate programme – East & Southern Africa. Open to English speaking applicants from East & Southern Africa and Europe, we aim with this combination to support journalists from these two regions in developing stories that are more in-depth and more cross-regional than ever before.

Strengthening Collaboration to Combat Kleptocracy

Addressing corruption and kleptocratic practices has grown in importance over the past decade, with jurisdictions across the globe introducing new legislative and policy tools designed to strengthen their response to the inflows of corrupt wealth. With this project, we aim to build on these achievements through: supporting strong cross-country and cross-continental partnerships between civil society engaged in combatting kleptocracy.

Further reading

Reports

Asset Recovery Frameworks, Practice and the Role of Civil Society in East And Southern Africa

Drawing on national studies conducted by CiFAR in seven countries in East and Southern Africa, this report compiles information about asset recovery legislative and policy frameworks set out by governments, as well as civil society activity in this area and makes cross-country comparisons. This report looks at seven countries with a diverse level of asset recovery activity across these two regions: Burundi, Ethiopia, Kenya, Mozambique, South Africa, Uganda and Zambia.

Sanctions As a Tool For Asset Recovery: Mozambique

This research study assesses the current state of play in the use of sanctions as an asset recovery tool, examining their application in Mozambique, and their prospects for addressing grand corruption. The Government of Mozambique and the international partners have been struggling to locate and repatriate the assets stolen in the Hidden-Debt scandal in 2016 which brought the country to economic collapse.

Blogs

Mozambique: The Hidden Debt Case

Mozambique is one of the poorest countries in the world, with a GDP of US$11 billion in 2016. In the last year a US$2 billion case has embroiled the country and has the potential for far reaching consequences. The Hidden Debt case involved a confidential US$2 billion loan from the UK branches of the Swiss Bank Credit Suisse and the Russian Bank VTB Capital to partially state-owned companies in Mozambique with a state guarantee.