Overview

Germany ranks well internationally in terms of corruption perceptions in Transparency International’s Corruption Perception Index,1 relatively well in terms of anti-money laundering in the Basel Anti-Money Laundering Index2 and has good indicators on voice and accountability3 and press freedom.4 However, Germany is one of the top ten worst countries in the Financial Secrecy Index, due to relatively limited financial transparency and high levels of financial flows globally.5

Germany has recently introduced several legislative reforms, primarily around the fourth EU anti-money laundering directive, and has started to strengthen its asset recovery capacity in light of increasing public awareness.

Case research reveals a considerable number of cases where there are more or less specific allegations of links to Germany but where no German assets have so far been identified.

Some cases with potentially illicit assets in Germany have been identified as part of investigations outside of Germany (particularly in the US) and by investigative journalists, but there seems to be little apparent follow-up in Germany. As such, Germany continues without any high-profile cases of assets returned to developing countries and, while several of its OECD peers have successfully used alternative approaches to asset recovery in the past, and Germany has only very recently taken steps to catch up.

Legal reforms

Germany has recently introduced several legislative reforms, primarily around the fourth EU anti-money laundering directive, and has started to strengthen its asset recovery capacity in light of increasing public awareness.

It reformed its confiscation rules significantly in 2017. The new law allows asset confiscation without a completed criminal case and with a lower burden of proof for cases of organized crime and terrorism. Several federal states have introduced or strengthened dedicated asset recovery units, and initial evidence points to a significant increase of asset confiscations. Nevertheless, the reform was not primarily targeted at the recovery of illicit assets from corruption and developing countries, and the impact of these new provisions in this respect remains unclear.

Germany also moved its Financial Intelligence Unit (FIU) in 2017 from the Federal Police to the Central Customs Authority, under the Ministry of Finance. According to interviews, the new FIU can potentially exchange information through administrative channels, analyze suspicious transaction reports without needing sufficient evidence of a crime and institute administrative asset freezes. Nevertheless, unlike in the UK where such asset freezes can be extended without limits, in Germany they are valid only up to one month

Cases

While there are no large-scale open cases in Germany, several ongoing investigations have links to Germany. This includes cases related to:

- de Achaval and Macri / Argentina

- Hosni Mubarak / Egypt

- Bacharuddin Jusuf Habibie / Indonesia

- Rackat Alijev / Nursultan Nasarbajew / Kazakhstan

- Muammar al Gaddafi / Libya

- 1MDB / Malaysia

- Abacha / Nigeria

- Russian Laundromat / Russia

- Ben Ali / Tunisia

International institutional engagement

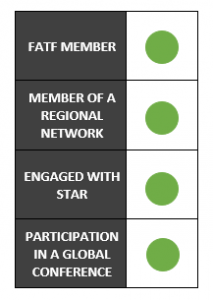

Germany has been a member of the Financial Action Task Force since 1990 and is an observer to the Eurasian Group (EAG), Asia/Pacific Group on Money Laundering (APG) and the Financial Action Task Force of Latin America (GAFILAT). Its next tentative date of evaluation is October / November 2020.

It is a member of the Camden Asset Recovery Inter-Agency Network and has participated in several international forums.

Our Reports on Germany

References

- https://www.transparency.org/cpi2018

- https://www.baselgovernance.org/basel-aml-index/public-ranking

- https://info.worldbank.org/governance/wgi/Home/Reports

- https://rsf.org/en/ranking

- https://www.financialsecrecyindex.com/PDF/Germany.pdf

All other information taken from Stolen asset recovery between Germany and developing countries